Best I Test Forbrukslån Uten Sikkerhet: Unsecured Loan Reviews

Unsecured loans are loans obtained without collateral. In recent years, this form of loan has become a popular financial option for individuals seeking financing without the need to provide collateral. The addition of the word ‘review’ to unsecured consumer loans has its significance. This article will examine what it means, find out how to get credit, and consider the merits and demerits of the practice of relying on reviews.

What Does Consumer Loan Review Mean?

Consumer loan reviews are ratings that have been properly evaluated and certified to be the best in comparison to other consumer loan offers in the market. It means that it has been subjected to rigorous testing and analysis to make sure it passes specified high-metric indicators like standard quality, affordability, and customer satisfaction.

These ratings are often given by reputable financial institutions. The concept of consumer loan reviews otherwise known as best i test forbrukslån in Norwegian parlance, is assessed based on critical key standards. Some of the key criteria include repayment terms, interest rates, loan flexibility, and customer reviews. By looking through reviews, customers can determine which lenders will offer them the best terms even without having had any personal dealings with them.

How to Choose a Lender after Going through Reviews

Having gone through various reviews, you still have to make your choice from the lenders presented in said reviews. While recommendations may have been made, it’s still up to you to make the right decision to ensure that you choose a lender that will offer you the best terms and service experience.

So, we’ll quickly discuss some inputs you have to make to ensure that the reviews you have studied serve you well. By taking the following steps, you will increase your chances of getting the best loan deal for you.

Know or Understand Your Financial Needs

Before setting out to take an unsecured loan, you’ll need to critically assess your financial needs. Determining the specifics of the credit you seek, will help you make informed decisions, especially when comparing loan options. For example, seeking financing can be for various reasons like education, debt consolidation, home development, general life improvement, etc.

Find Out and Compare Lending Organizations

Even with the reviews, finding good and reliable lenders can be difficult. So, ample time has to be devoted to studying and vetting them. Look for financial institutions with a good track record. Also, before making a final choice, compare terms and conditions, interest rates, and other fees. Make an effort to understand extensively the nature of the loan you intend to take.

Check the Interest Rates and Fees

The interest rate is one big factor you must consider before settling down for an unsecured loan. Apart from this, examine other associated charges like processing fees, repayment penalties, or originating fees. These additional fees shouldn’t be ignored because they can significantly alter the dynamics of the whole loan program.

Evaluate the Loan Term and Repayment Plan

Compare the loan terms and repayment options of different lenders and choose the one that best suits your immediate and long-term financial goals and capabilities. For example, dynamics such as a longer loan term, lower monthly repayments, and higher overall interest rates as compared to when it’s vice-versa should be considered thoroughly.

Eligibility and Loan Amount

Lending organizations often have limits on the loans they give. So, you’ve got to find out the limit and, confirm your eligibility for the facility. Beware of the urge to access more than you need, even if they’re offering it to you. As this will plunge you into unnecessary debt.

Confirm The Lender’s Credibility

You need to be sure of the lender’s credibility and reputation. You can do this by researching on the internet and getting customer reviews. Useful tips and insights from the experiences of other borrowers will help you avoid pitfalls and identify lenders with repute and avowed transparency.

Consider Seeking Professional Advice

Many individuals sign the dotted lines without fully understanding the terms or embedded complexities involved in their financing package. If you are in doubt for any reason or do not fully understand the terms and conditions, seek professional advice. Although this will come at an additional cost, it will be worth it. Check and cross-check vital issues like interest rates and any clauses included.

Benefits of Unsecured Consumer Loans

So why will you want to go through all these hassles to get this credit facility? The truth is that an unsecured facility presents the borrower with several benefits. Let us consider a few of them.

Fast and Easy Access to Funds

Unsecured loans are easy and quick to get. So long as the borrower meets the set criteria, the application process is simplified and streamlined to make quick access to funds within a matter of days possible.

No Collateral, No Risk to Personal Assets

Unlike secured loans, where you’ll have to obtain the facility by tying it to an asset, this is not the case here. The loan is collateral-free! You don’t have to pledge anything. This gives peace of mind and the added vitality to focus at work, making repayment of the loan comparatively much easier.

Flexibility in Loan Utilization

Usually, a lot of flexibility comes with this option of financing. You will be able to use the loan across a wider spectrum. The flexibility and terms offered for a line of credit are very similar to that of consumer loans without security. Check here to read more about it. The freedom to allocate the credit according to your priorities is a huge plus.

Simplified Application Process

Many lending organizations have simplified the process of obtaining these loans. In most cases, borrowers simply apply online or through other digital platforms without any bottlenecks or paperwork. This saves a lot of time and provides a very convenient way to borrow.

Disadvantages of Unsecured Consumer Loans

As good as an unsecured loan is, it has its shortcomings. Let us find out some of the drawbacks of getting this financing plan.

Very High-Interest Rates

Compared to secured loans, the interest rates for this option are very high. This is to compensate for the high risk the lenders take by not asking you for collateral. Given this, you are advised to do your calculations well to ensure that taking a consumer loan without collateral is the best option for you.

It has Stricter Qualification Requirements

You have to meet very strict eligibility criteria since you aren’t required to bring any collateral. This means that your creditworthiness, credit scores, previous credit history, etc. will need to be high for you to qualify.

Potentially Lower Loan Amounts

Lenders offer lower maximum limits compared to what is obtainable in the secured variation. They limit the borrower’s credit in line with his income, repayment capacity, and creditworthiness. This can be a serious challenge for individuals with significant funding needs.

Conclusion

An unsecured loan is a credit facility that stands out from the rest in terms of affordability, terms, and general customer satisfaction. Individuals can easily access it for credits as long as they satisfy the eligibility criteria. Because no assets are required, people are comfortable taking the facility even though the interest rates are comparatively higher than what is obtainable with secured loans.

Overall, this loan option is popular among borrowers because it has proven to be beneficial to them. Also, the fact that over time it’s been proven to post better performance than its competitors stands it out.

Overall, this loan option is popular among borrowers because it has proven to be beneficial to them. Also, the fact that over time it’s been proven to post better performance than its competitors stands it out.

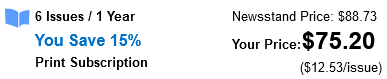

World Finance Magazine Subscription